Do you want to learn more about cryptocurrencies but feel overwhelmed? Please rest assured that this detailed beginner’s guide will help you. This beginner’s PDF book will teach you everything about cryptocurrencies, whether you’re a techie trying to get into digital assets or just interested. Prepare for an amazing voyage into decentralized money!

In short, cryptocurrency is

- Digital currency such as cryptocurrency functions independently of banks. Unlike traditional money, cryptocurrencies are digital and secure. Transaction security and unit production are protected by this encryption technology.

- Digital currency is decentralized, meaning no government or financial entity controls it. A blockchain network of computers verifies transactions.

- Decentralized cryptocurrency began with Bitcoin, established in 2009 by Satoshi Nakamoto. Thousands more cryptocurrencies with different features and uses have arisen since then.

- Cryptocurrencies provide reduced transaction fees and speedier cross-border transfers than fiat currencies. In the ever-changing financial landscape, its growing popularity has attracted investors seeking diversification.

Cryptocurrency timeline

- Bitcoin, the first decentralized digital money, was introduced by Satoshi Nakamoto in the late 2000s. Financial technology changed with Bitcoin’s 2009 debut.

- Many altcoins were created after Bitcoin’s success with unique features and goals. Digital currencies were created to overcome Bitcoin’s limitations and investigate blockchain possibilities beyond trading.

- Because it allowed secure and efficient transactions without banks or governments, cryptocurrency gained popularity. Blockchain, which underpins these digital assets, transformed data storage and verification across computers.

- In today’s linked world, understanding cryptocurrencies’ history and significance is crucial as they shape finance and technology.

Cryptocurrencies types

- Coins come in many varieties. The first cryptocurrency, Bitcoin, is still the most popular. Instead, Ethereum enabled smart contracts and decentralized apps.

- Enabling real-time cross-border payments distinguishes Ripple. Bitcoin takes longer to process transactions than Litecoin due to its mining algorithm. The untraceable transactions of Monero offer privacy.

- Stellar offers low-cost cross-asset transfers and financial inclusivity. The Masternode network of Dash enables rapid, confidential transactions.

- Every cryptocurrency has its own features and functions to meet the changing needs of the digital asset market.

Start Cryptocurrency

- You’ve decided to try crypto. Start with a trustworthy cryptocurrency exchange site to buy, sell, and store your digital assets.

- You must register and verify on a platform after choosing it. Verifying your identification and submitting personal information is normal.

- You can fund your account with money or cryptocurrency after signing up. After researching market trends, buy your selected cryptocurrency.

- It’s important to research cryptocurrencies’ usage and value before investing. First try Bitcoin or Ethereum, then other cryptocurrencies.

- Secure your cryptocurrency with two-factor authentication and offline wallets to avoid cyberattacks.

Knowledge of Blockchain

- The decentralized digital ledger of blockchain technology records transactions across a network of computers, powering cryptocurrencies. The system is secure and transparent since each block has a cryptographic hash of the previous block.

- A key feature of blockchain is its immutability: data cannot be changed without network consensus. Intermediaries are eliminated and confidence is established.

- Blockchain technology also allows smart contracts to self-execute under certain situations. Automation boosts efficiency and reduces fraud and errors.

- Understand blockchain technology to realize its revolutionary potential beyond currency. In supply chain management, voting systems, healthcare records, and more, it improves openness and efficiency.

Digital Currency Investment Benefits and Risks

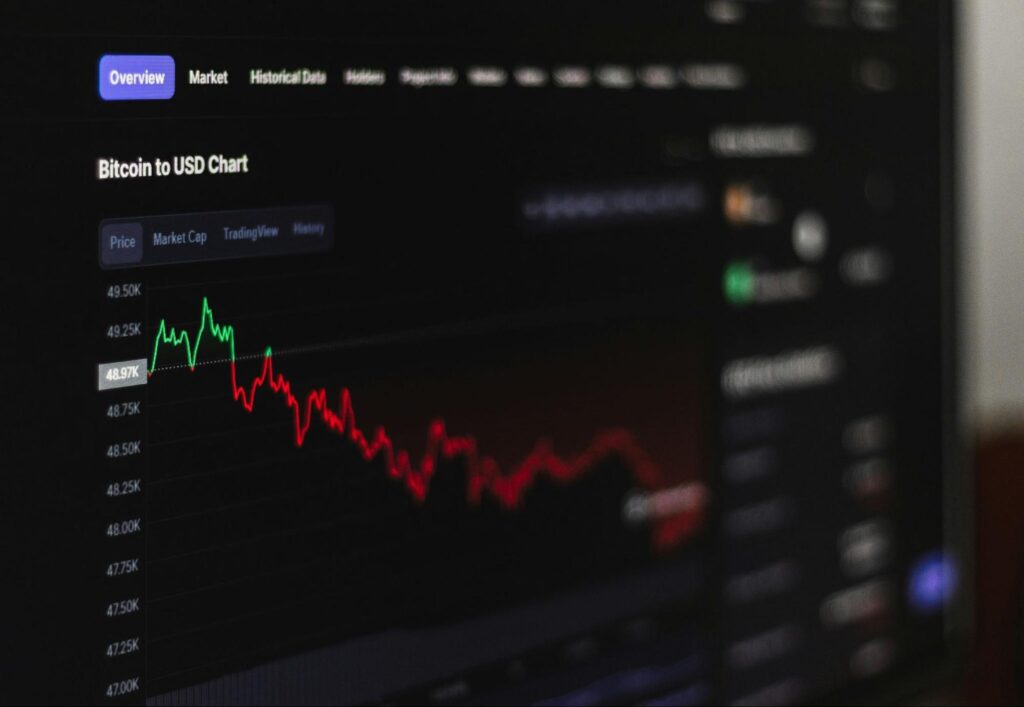

- Cryptocurrency investing has pros and cons that beginners should know. Some cryptocurrencies have skyrocketed in value, offering substantial returns on investment. Informed investors can earn greatly from this.

- Cryptocurrency market volatility is another risk. If not managed, short-term price fluctuations might cause losses. Secure wallets and exchanges are crucial to crypto security due to hacking and scams.

- These concerns aside, cryptocurrencies’ decentralization and financial freedom appeal to many. Before entering this thrilling but unpredictable industry, newbies must research and consult seasoned investors.

Crypto’s Future

- Future cryptocurrency innovation and adoption are huge. Bitcoin may become widespread in numerous businesses as technology advances. With security and scalability improvements, digital currencies could transform finance.

- Because more people comprehend blockchain technology and its benefits, cryptocurrency adoption is projected to rise tremendously. Decentralized finance can challenge banking systems and provide people more asset control.

- Global governments are increasingly accepting digital assets, as shown by central bank digital currencies (CBDCs). This approval boosts cryptocurrency’s global legitimacy.

- The future of Bitcoin seems bright as it disrupts financial norms and creates a more inclusive and efficient economy.

Cryptocurrency Misconceptions

- Cryptocurrency fallacies can prevent newbies from researching this interesting digital asset. The idea that cryptocurrency is solely utilized for unlawful acts because of its anonymity is widespread. Despite some criminals using crypto for illegal purposes, most transactions are legal and transparent.

- Misconception: all cryptocurrencies are scams. There have been fraudulent initiatives, but Bitcoin and Ethereum are actual assets with real-world applications.

- Many think investing in Bitcoin guarantees rapid wealth. Investing in crypto markets requires prudence and investigation due to their volatility.

- Beginners should learn about cryptocurrencies to discern fact from fiction in this fast-changing field.

Strategies for Crypto Trading

- Trading crypto successfully requires being informed. Observe market trends, news, and laws that may affect cryptocurrency pricing.

- Invest in diversification. By investing in multiple cryptocurrencies, you can reduce losses if one drops drastically.

- Stick to defined aims. Strategize your trading decisions for short-term earnings or long-term investments.

- Secure your private keys and use trusted exchanges. Your funds must be protected in the volatile crypto market.

- Manage your trades without emotion. Avoid market rashness and make rational decisions based on study.

- Make use of stop-loss orders to sell cryptocurrencies automatically if their prices drop. This reduces volatility-related losses.

- Patience pays in crypto trading. Despite price swings, a long-term view may yield better results.

Conclusion

- In the future, cryptocurrency could change money and technology. This thorough PDF book for beginners covers cryptocurrency’s history, types, benefits, hazards, and trading methods. Learning about cryptocurrency is vital for entering this exciting world.

- Now is the moment to explore this dynamic environment as blockchain technology advances and cryptocurrencies gain popularity. With education and caution, people can invest and trade crypto assets safely.

- Keep up with market trends, learn about new developments in the sector, and invest responsibly as you enter the cryptocurrency world. Keeping an open mind regarding cryptocurrencies might help you capitalize on growth prospects while minimizing risk.

- Join the Bitcoin world with confidence thanks to our detailed guide. Good investing!